Part time salary tax calculator

Updated for April 2022. There are two options in case you have two different.

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

The adjusted annual salary can be calculated as.

. The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 202223. That means that your net pay will be 43041 per year or 3587 per month. Simple steps to lodge your 2022 tax return online.

Free SARS Income Tax Calculator 2023 TaxTim SA. Pro-Rata Calculator Breakdown your pro-rata income select tax year. The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New.

Some deductions from your paycheck are made. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. For example for 5 hours a month at time and a half enter 5 15.

Your average tax rate is. Annual full-time salary 52 Full time weekly hours x. Just enter the full-time equivalent salary the number of hours you work and optionally adjust the number of full-time hours - although weve preset that at 40 hours for you.

Some companies pay part-time employees a discounted rate that is less than the equivalent full-time salary. The Salary Calculator has been updated with the latest tax rates which. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

To stop the auto-calculation you will need to delete. Part-time salaries are typically based on full-time salaries divided by the number of hours worked. Instant salary calculation for 202223 tax.

Mathematical formula to calculate pro rata pay Theres a mathematical formula to calculate pro rata pay which is. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 20222023 Federal and State Income Tax Salary Calculator.

So normal part-timers dont need to pay income tax if annual income is less than 1030000 yen while 1300000 yen for part-time working students. That means that your net pay will be 45925 per year or 3827 per month. How Income Taxes Are Calculated.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. In any negotiation always try to get the other party to say a number first. How to calculate Australian goods and services tax.

In the Weekly hours field. Your average tax rate is. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above.

Up next in Income tax. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

The PAYE Calculator will auto calculate your saved Main gross salary. Discover Helpful Information And Resources On Taxes From AARP. Sacrificing part of your salary can reduce your tax.

Thats as true for part-time work as for salary work. You can change the calculation by saving a new Main income. Salary calculator for part time jobs posted on july 21 2012 by admin following requests from visitors to be able to change the.

Click here to see why you still need to file to get your Tax Refund. If you are on furlough you can also add the percentage to which your salary has been furloughed too. Lodging a tax return.

Income Tax Rate ranges from 5 to 45. Enter the number of hours and the rate at which you will get paid. Input salary benefits provide your full-time weekly monthly or annual salary holiday entitlement and the percentage you contribute to your pension.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Net Pay Step By Step Example

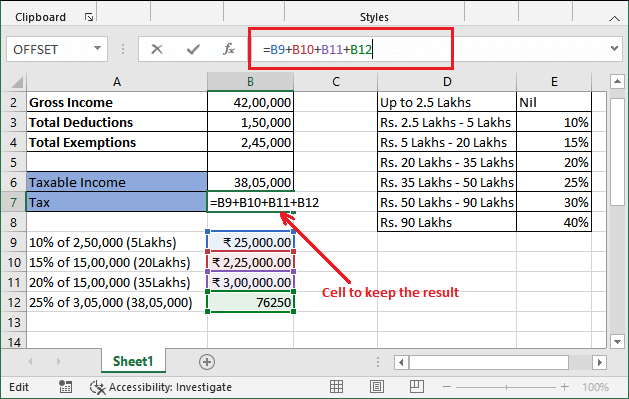

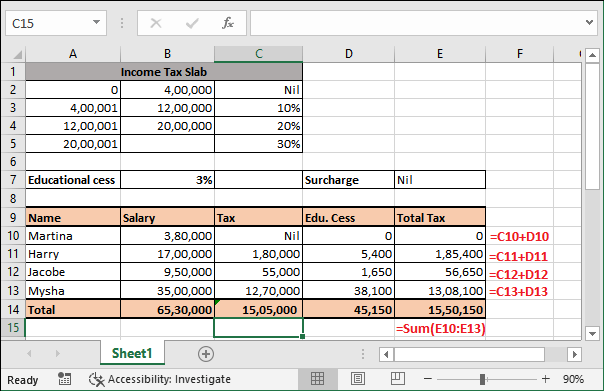

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Income Tax Formula Excel University

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Effective Tax Rate Formula Calculator Excel Template

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculating Formula In Excel Javatpoint

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Payroll Tax Calculator For Employers Gusto